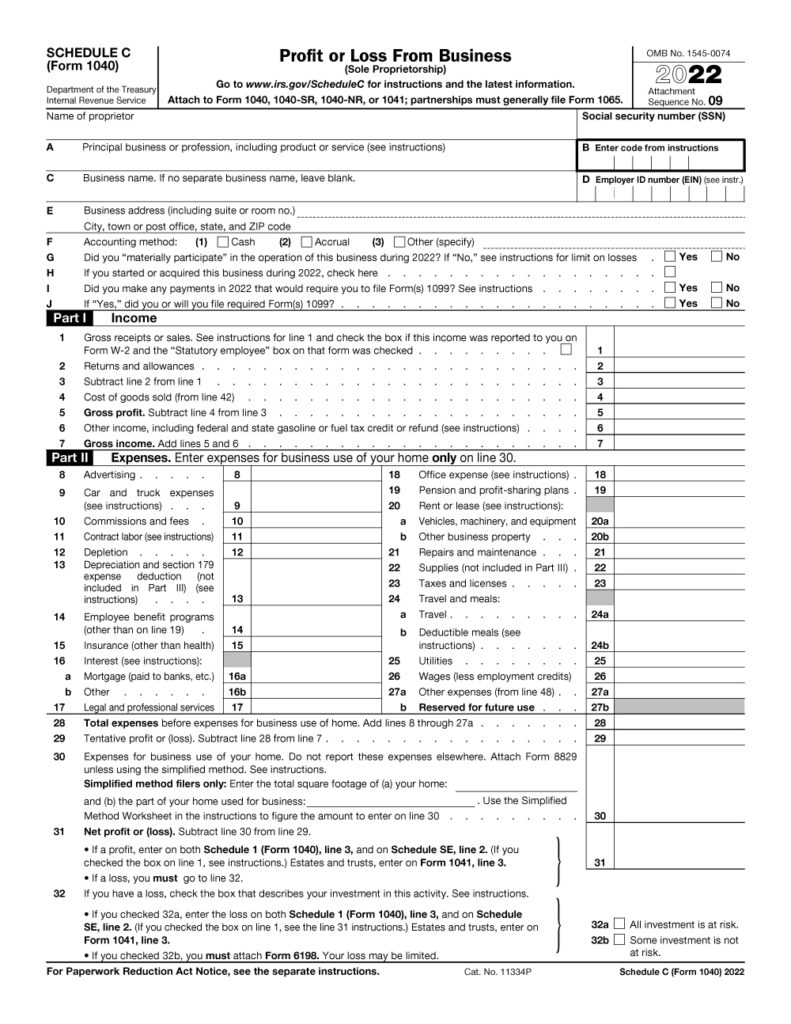

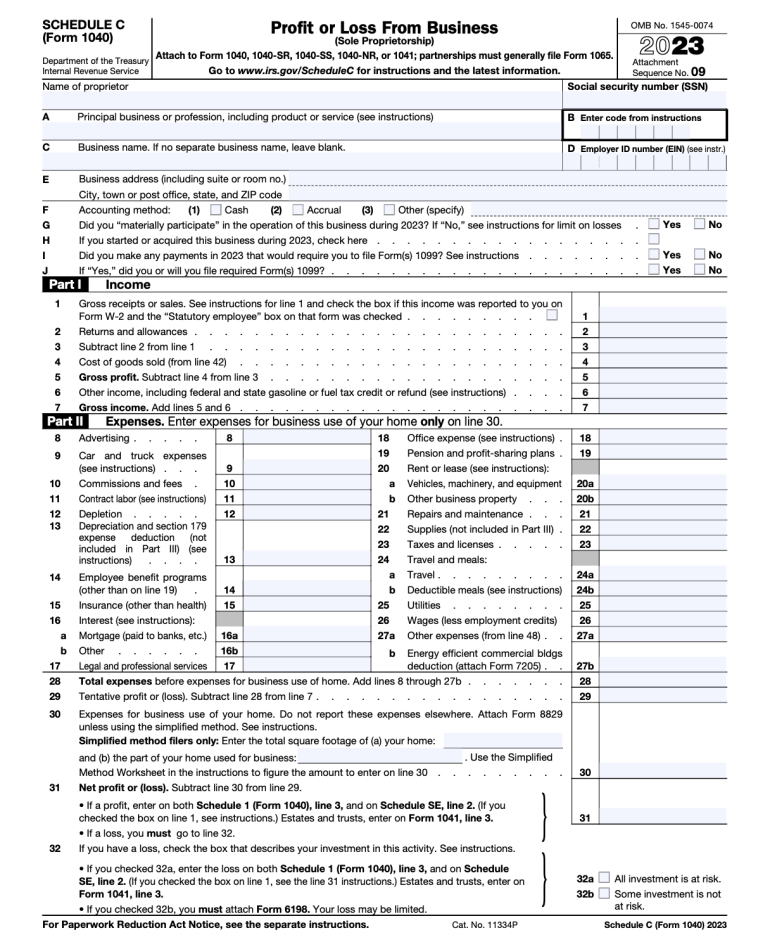

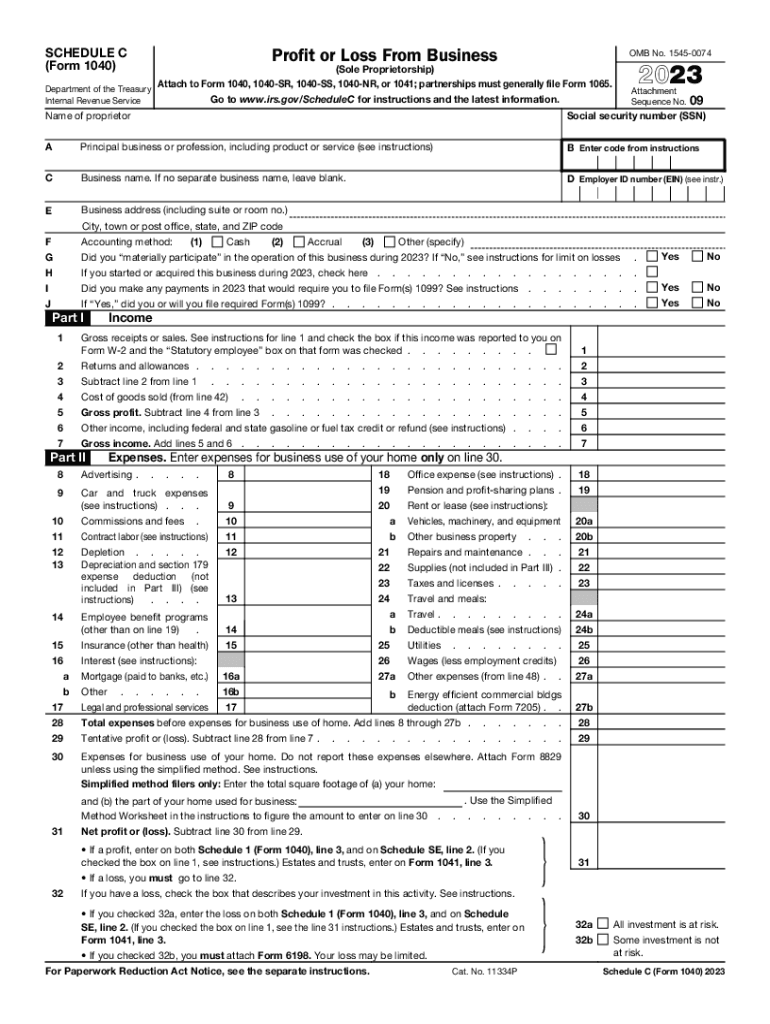

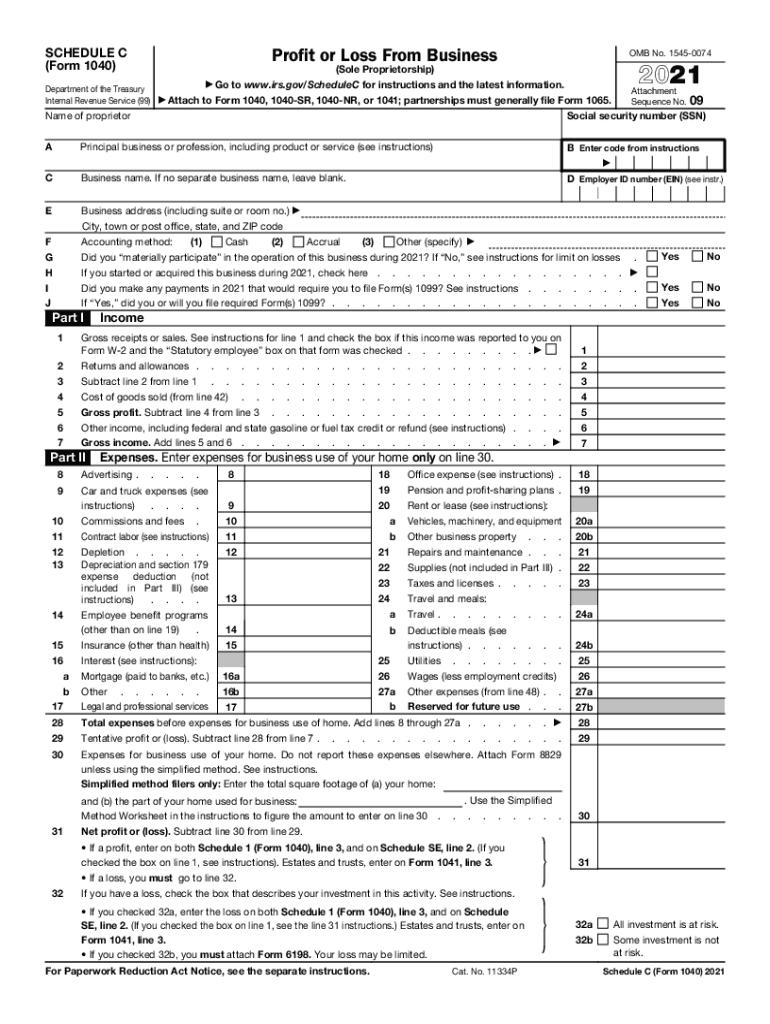

2024 Form 1040 Schedule C Instruction – When you decide to close your sole proprietorship, there are no special instructions to follow Attach the Schedule C to your regular form 1040. Submit the forms to the IRS. . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Form 1040 Schedule C Instruction

Source : irs-schedule-c-ez.pdffiller.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.com2023 Instructions for Schedule C

Source : www.irs.govSchedule C (Form 1040) 2023 Instructions

Source : lili.coWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comHarbor Financial Announces IRS Tax Form 1040 Schedule C Instruct

Source : northeast.newschannelnebraska.com2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Source : instruction-schedule-c.pdffiller.comSchedule C: Your Easy Step By Step Instruction Guide

Source : craftybase.com1040 schedule c: Fill out & sign online | DocHub

Source : www.dochub.com2024 Form 1040 Schedule C Instruction 2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable : Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a . Are there ways to reduce this tax burden? Here’s what you need to know. Schedule C (1040) is an IRS tax form for reporting business-related income and expenses. Its official name is Profit or Loss .

]]>